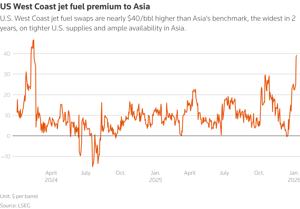

U.S. West Coast jet fuel's premium to Asia near its widest in nearly 2 yrs

- S. West Coast jet fuel prices nearly $40/bbl higher than Asia

- Supply curtailment in U.S. West Coast is main supportive factor

- Asian markets are sufficiently supplied

The premium for prompt U.S. West Coast jet fuel to Asia has reached its widest in nearly 2 yrs, LSEG data showed on Thursday, as refinery outages curbed U.S. supply and slower Chinese demand increased the fuel's availability in Asia.

The February Los Angeles jet fuel derivative price is nearly $40/bbl higher than Asia's benchmark, according to the data, a level last hit in mid-February 2024.

(click image to enlarge)

Traders say they hope the increased jet fuel price spread for the two regions on paper will lead to more shipments from Asia to the U.S. West Coast.

Weak demand for jet fuel in China has added to the downward pressure on Asia's prices, said Matias Togni, analyst at NextBarrel. China's total flight numbers have fallen by 1.6% so far this year from the same period last year, data from flight tracking service Airportia showed.

Closures and refinery outages reduce U.S. output. In the United States, refinery outages have reduced fuel output and permanent plant closures will further tighten supplies, analysts said.

The Asia-U.S. West Coast jet fuel price spread has widened as the availability of jet fuel barrels in the U.S. West Coast has shrunk, mainly because of an extended outage at PBF Energy's refinery in Martinez, California, Vortexa's head of APAC analysis Ivan Mathews said.

In addition, a jet fuel unit at Chevron's 285,000-bpd El Segundo refinery has been under repair since a fire in October.

U.S. West Coast jet fuel stocks were near two-month lows of 11.19 MMbbl on January 2, data from the U.S. Energy Information Administration showed. The region's refinery utilization fell to 80% in the week ended January 2, compared with 85.4% in the same period last year, the data showed.

Further tightening supply, Valero plans to gradually wind down operations at its 145,000-bpd Benicia refinery in California from February, the company said on Wednesday, after Phillips 66 shuttered its 139,000-bpd Los Angeles site late last year.

Together the two plants account for about 11% of the total refining capacity in the U.S. West Coast.

Asia-USWC shipments may increase. Two trade sources said they expected Asian jet fuel exports to the U.S. West Coast to hit 500,000 tons–600,000 tons (3.94 MMbbl–4.72 MMbbl) this month as sellers try to cash in on higher margins despite the prompt delivery timeframe.

So far this month, shipments are slightly below 100,000 metric tons, ship-tracking data from Kpler and LSEG showed.

Comments