Opinion: Win or lose, Trump’s fossil fuel gamble crowns China the clean-energy king

President Donald Trump’s bid to ignite American industry with cheap oil and gas is a high‑stakes gamble that, win or lose, will leave China the world’s leading low‑carbon technology powerhouse.

These opposing energy strategies reflect deep geopolitical divides that will shape the contest between the world’s two largest economies for industrial supremacy in the coming decades.

Trump has made no secret of his fondness for fossil fuels – and distaste for renewables. He’s slashed government support for electric vehicles and low‑carbon technologies, expanded oil drilling access, and loosened environmental rules.

Washington’s recent ouster of Venezuela’s President Nicolas Maduro and subsequent push for U.S. firms to tap the country’s vast proven oil reserves – the largest in the world at 303 Bbbl, according to OPEC – offer the clearest signal yet of the administration’s intention to lock the U.S. economy into a fossil‑fuel‑driven future.

This ambition was spelled out in the White House national security strategy released late last year. It argued that abundant U.S. oil, gas, coal and nuclear resources will “fuel reindustrialization” and preserve America’s edge in technologies such as artificial intelligence.

The U.S., the world’s biggest economy and largest oil consumer, accounted for around one‑fifth of global demand in 2025, or some 20.6 MMbpd. After a decade‑long shale boom, it is now also the top oil and gas producer.

The U.S. is also now the largest liquefied natural gas (LNG) exporter, shipping over 110 MM tonnes (t) last year, or roughly a quarter of global trade.

Given this access to massive, affordable energy supplies, it is understandable that the U.S. would double down on fossil fuels. But this strategy may be short-sighted, and not just because of the climate implications. The White House appears to be ceding the energy future to America’s biggest economic rival.

Chinese independence. America’s recommitment to a 20th‑century industrial model diverges sharply from Beijing’s effort to break its dependence on fossil fuels, which were the foundation of its economic ascent this century.

Beijing’s latest five‑year plan underscores its drive for self‑reliance in energy, critical minerals, and advanced technologies such as semiconductors and artificial intelligence.

To complete this ambitious shift, China has launched an economy‑wide electrification push and built entire industries to support an “electrostate,” becoming the unrivalled global leader in solar, batteries, and electric vehicles.

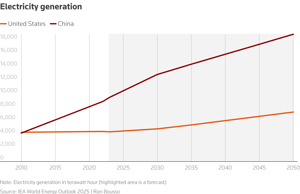

(click image to enlarge)

EVs made up more than half of Chinese domestic passenger car sales last year, while Chinese manufacturers produced over 70% of the world’s EVs. Electric truck sales are also rising in China, steadily displacing diesel demand.

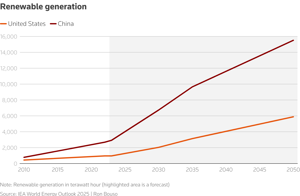

The country is deploying renewable energy at breakneck speed. It installed more than 500 gigawatts (GW) of new solar and wind capacity last year, the largest single‑year buildout in history, according to government data. The International Energy Agency expects China to account for more than two‑thirds of global solar and wind additions in 2025.

(click image to enlarge)

However, despite this massive renewables push, China is still highly reliant on foreign energy supplies. The country imported around 10.4 MMbpd of oil in 2025, up from 6 MMbpd a decade earlier, Kpler data shows. Oil imports continue to cover more than 60% of China’s consumption.

(click image to enlarge)

Imports are expected to decline gradually as EV adoption rises, but China’s heavy reliance on overseas oil remains an Achilles’ heel, highlighting the urgency of Beijing’s strategic energy shift.

Perhaps ironically, Washington’s Venezuelan gambit and its threatened military action against Iran may actually speed up this drive. The two countries collectively supply over 7% of China’s oil needs. Washington’s apparent willingness to disrupt these supplies will likely cement Beijing’s strategy.

Who wins? Future U.S. administrations may reverse Trump’s policies, but even if they do, policy whiplash will hamper America’s ability to catch up with China in the race for new energy dominance.

A fossil‑fuel‑centric strategy carries other risks as well, such as the simple fact that these resources are finite. Oil and gas fields get depleted, requiring constant reinvestment, raising the risk of price volatility.

Renewables require heavy upfront investment and still require backup systems – often powered by gas or coal – to cover periods of low sun and wind. This can also trigger bouts of volatility. But renewables have far more potential upside and greater ability to benefit from technological breakthroughs.

Perhaps most importantly, the administration’s direct intervention in favor of one particular energy source – and opposition to new technologies – marks a sharp break from the long‑standing U.S. credo of letting markets determine winners and losers. This approach has historically delivered lower costs and faster innovation, enabling the U.S. to become the reigning global superpower. If Trump’s gamble doesn’t pay off, that could change.

The opinions expressed here are those of Ron Bousso, a columnist for Reuters.

Comments