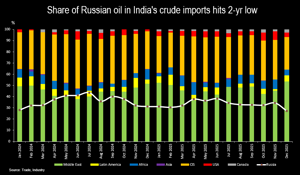

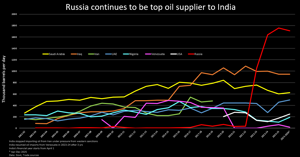

Indian refiners shift oil strategy, trim Russian buys and turn to Middle East

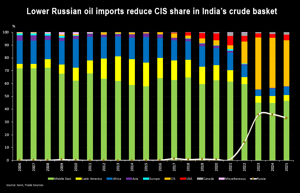

- Indian refiners to gradually cut Russian oil imports

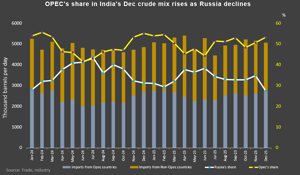

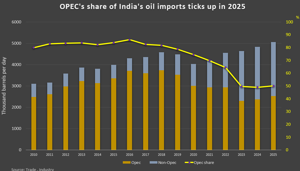

- OPEC's share in Indian oil imports rises

Indian refiners are redrawing crude import strategies to shift away from top supplier Russia and boost imports from the Middle East, a move that could help New Delhi clinch a trade deal with the United States to lower tariffs.

(click image to enlarge)

India became the top buyer of discounted Russian seaborne crude after the 2022 outbreak of war in Ukraine, but the trade drew backlash from Western nations targeting Russia's energy sector with sanctions, saying oil revenues help it fund the war.

The shift away from Russia comes as Middle East producers, armed with higher output quotas from the Organization of the Petroleum Exporting Countries (OPEC), are keeping global markets well-supplied, softening the impact on prices.

(click image to enlarge)

(click image to enlarge)

India refiners scale back Russian buys. Indian refiners have begun scaling back Russian oil purchases following discussions at a government meeting to help accelerate a U.S.-India trade deal, three refining sources said.

(click image to enlarge)

The oil ministry's Petroleum Planning and Analysis Cell is collecting weekly data on refiners' purchases of Russia and U.S. crude, sources said this month.

In the latest change, state refiner Bharat Petroleum Corp. awarded one-year tenders to buy Iraqi Basrah and Omani crude to trader Trafigura and is in the market to buy Murban oil from the United Arab Emirates under a separate tender, said the sources, who sought anonymity.

From April, Trafigura will supply four cargoes of Oman crude every quarter at 75 cents a barrel below Dubai quotes and one parcel of Basrah Medium at a discount of 40 cents a barrel to the grade's official selling price, said two traders.

BPCL and India's oil ministry did not respond to requests for comments.

Doubling of import tariffs a punishment for Russia buys. The United States, already seeking to narrow its trade deficit with India, doubled import tariffs on Indian goods to 50% last year to punish it for heavy purchases of Russian oil.

State-run Hindustan Petroleum, Mangalore Refinery and Petrochemicals and private refiners HPCL-Mittal Energy Ltd. have already stopped buying Russian oil.

India's Russian oil imports fell to their lowest in two years in December, while OPEC's share of imports hit an 11-month high, trade data showed.

(click image to enlarge)

Apart from the Middle East, Indian refiners have also increased purchases from regions such as Africa and South America.

Indian refiners have also boosted purchases of U.S. oil to partly replace Russian oil and narrow the trade deficit with Washington, while also scouting for Venezuelan oil.

Comments