Opinion: Trump’s Russian oil sanctions gambit will test his tolerance for pain

- S. imposes sanctions on Rosneft, Lukoil

- India, Turkey will likely cut purchases of Russian oil

- Unclear if China will adhere to the sanctions

U.S. President Donald Trump imposed sanctions on Russia's two largest oil companies, marking a significant escalation in his efforts to starve Moscow of vital revenue to fund its war in Ukraine.

The effectiveness of these measures - which target Russia's Lukoil and Rosneft - will, however, hinge on Trump's willingness to enforce secondary sanctions and risk an energy price spike.

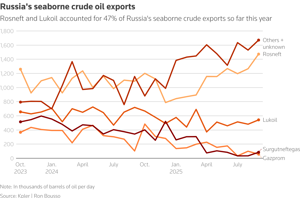

Oil prices gained over 5% following news of the sanctions, with traders fearing a drop in global oil volumes. Rosneft and Lukoil collectively produce roughly 5% of global oil supplies, or around 5.3 MMbpd. Their combined exports thus far in 2025 have accounted for 47% of total seaborne exports of 3.5 MMbpd, according to analytics firm Kpler.

(click image to enlarge)

The U.S. designation of the two Russian companies, which follows Britain's decision last week to hit Rosneft and Lukoil with sanctions, cuts them off from the dollar-based financial system.

At first glance, the new U.S. measures appear unlikely to have a major impact on Russian exports, given that Russian energy companies have in recent years developed efficient ways to circumvent most Western financial systems and sanctions, including the use of so-called “shadow fleets”. Russian crude oil and refined products exports have only declined slightly since Russia's invasion of Ukraine, falling from 8 MMbpd in 2022 to 7.5 MMbpd in 2024.

Crucially, however, the new sanctions expose any foreign company dealing with the two Russian firms to possible secondary U.S. sanctions.

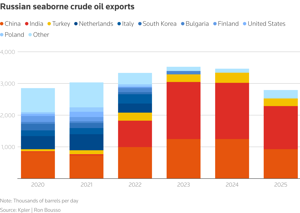

The key questions then are how India and China – the two biggest buyers of Russian crude – will respond, and whether Trump will be willing to tighten the screws on them if they don’t.

India is expected to be onboard. Up until recently, India had been strengthening its energy ties with Moscow.

India purchased 1.9 MMbpd of Russia’s crude in the first nine months of 2025, 40% of its total exports, according to the International Energy Agency. And Rosneft owns a 49% stake in India’s 400,000-bpd Vadinar refinery.

However, New Delhi is facing heavy pressure from Trump to reduce Russian crude purchases in exchange for a reduction in U.S. import tariffs. India is therefore likely to respond swiftly to the new sanctions by cutting Russian oil imports, even if it is painful for India’s domestic refining industry.

Turkey, the third largest buyer of Russian oil, is also likely to halt purchases.

(click image to enlarge)

China is the real test. The real test will be the reaction of China, the largest buyer of Russian crude.

China imported 2.1 MMbpd of Russian oil between January and September via land and sea, roughly 18% of the country's total crude imports. Imports from Russia via the ESPO pipeline, which delivers oil from fields owned by Rosneft, account for around 40% of that.

China may choose to pull back on its imports initially as a precautionary measure, especially if the U.S. move sparks a sustained price increase, but it is far from clear whether Beijing will comply with the sanctions, as it has repeatedly criticized previous measures.

Trump has so far refrained from putting heavy pressure on China over its Russian oil and gas purchases. While Washington has put sanctions on some small Chinese refineries, it has yet to take any action against Chinese companies involved in importing LNG from the heavily sanctioned Arctic LNG 2 facility in Russian Siberia.

If Trump chooses to target major Chinese companies with secondary sanctions, that would likely lead to retaliatory measures from Beijing. The two global superpowers are already locked in tense trade talks.

Timing is on Trump’s side. Trump may also be concerned about generating a sustained price spike, something that would be very unpopular with U.S. consumers.

But timing could be on his side.

If both China and India were to cut all or part of their Russian oil purchases, which make up nearly 75% of Russia’s crude sales, the market would need to source up to 4 MMbpd from alternative supplies.

However, the oil market is currently believed to be facing significant oversupply. The IEA forecasts a surplus of 2.35 MMbpd in 2025 and 4 MMbpd, or nearly 4% of global demand, next year.

The current projected surplus, therefore, offers Trump a significant cushion should he choose to further curb Russia's crude exports revenue.

Ultimately though, Russia is a big cog in the global oil market. If U.S. measures to limit Moscow’s exports are sustained and effective, this would inevitably lead to higher oil prices and market turmoil, which Trump will almost certainly want to avoid.

Trump may be betting that the threat of financial pain will bring Putin to the negotiating table quickly, limiting the risk of a sustained spike in oil prices that could hit U.S. consumers.

Whether he is willing to make that gamble – and also risk upsetting China – should become clear in the coming weeks.

The opinions expressed here are those of Ron Bousso, a columnist for Reuters.

Comments