VDMA: Industrial valves market grows by 8% in 1H of 2025

The industrial valves sector grew by 8 percent in the first half of 2025. Despite tariffs and weaker exports to China, the situation remains stable. The VDMA Valves expects sales to increase by around 4 percent for the year as a whole.

The industrial valves industry can look back on a successful first half of 2025. With an overall increase in sales of 8 percent (4 percent price-adjusted), the industry once again exceeded expectations. While domestic business grew by 6 percent, foreign business recorded an increase of 9 percent compared to the same period last year.

"Despite the tariff disputes with the US, the mood in German industry remains surprisingly stable," says Axel Weidner, Chairman of the German Valve Manufacturers' Association and partner at Mankenberg GmbH, commenting on the current situation.

The new German government's investment package could provide additional momentum in 2026. "Some customer industries, such as chemicals, are still cautious, but we expect impetus from other industrial sectors worldwide – especially from the future markets of hydrogen, energy production, and pharmaceuticals," emphasizes Weidner.

All divisions in the black. All product areas grew in the first half of the year: shut-off valves (+8 percent), safety and monitoring valves (+8 percent), and control valves (+6 percent). A turnaround was particularly evident in the domestic market after a weak previous year.

International business continued the positive trend of the previous year in all divisions. However, the outlook is somewhat more subdued. According to figures from VDMA, order intake fell by 1 percent in real terms in the first half of the year. Only in the control valves segment did order intake exceed the previous year's figure in price-adjusted terms.

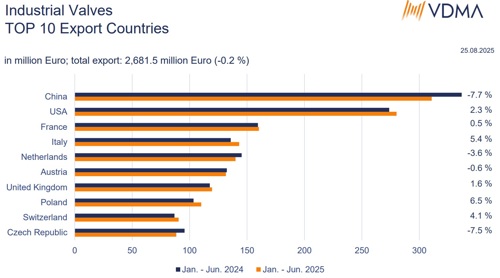

Export business facing headwinds. Exports reached a value of 2.7 billion euros in the first six months of 2025, remaining virtually stable (-0.2 percent). China, the most important sales market, lost significant momentum. Exports to the People's Republic fell by 7.7 percent to 310.8 million euros in the first half of the year. Exports to the second most important trading partner, the US, climbed by 2.3 percent to 280.2 million euros. Exports to France increased slightly by 0.5 percent. The country thus remained in third place among the most important sales markets with a purchase volume of 160.3 million euros.

"The Chinese market has become more demanding," explains Dr. Laura Dorfer, Managing Director of the VDMA Valve Association. "Our members are reporting declining export figures in the first half of the year and noticeable barriers to market access – partly due to a preference for national suppliers. At the same time, we are seeing Chinese competitors becoming increasingly active in our traditional foreign markets. Business in the US has remained robust so far, despite the tariff issue. However, international competition is intensifying significantly."

Outlook. Despite a challenging environment, the trade association expects sales to increase by around 4 percent for 2025 as a whole, given the good start to the year. "The second half of the year remains challenging, but the industry is well positioned to weather the crisis," says Dorfer.

Comments