Ukrainian strikes on Russian oil facilities could be a boon for U.S. refiners

The recent wave of Ukrainian drone attacks on Russian oil refineries and export facilities could boost global refining profit margins – particularly those in the U.S. – just as the peak summer demand season fades.

Ukrainian attacks have shut down facilities accounting for at least 17% of Russia's oil processing capacity, or 1.1 MMbpd, according to calculations. Other targeted infrastructure includes the Ust-Luga Baltic Sea oil export terminal and the Druzhba pipeline, which supplies Belarus, Slovakia and Hungary.

These strikes mark a significant escalation in the 3.5-yr conflict, with Kyiv now taking direct aim at the Kremlin's largest source of revenue while U.S. President Donald Trump seeks to broker a ceasefire deal.

Russia and Ukraine had agreed in March to halt attacks on energy infrastructure after a barrage of Russian attacks. But Moscow has already broken this agreement, hitting a number of Ukrainian energy targets in recent weeks, including drone attacks on power facilities in the north and south of the country.

Tensions escalated further this week when Russia launched its largest air offensive since the start of the war, hitting Ukraine’s main government building in Kyiv.

Disrupted refineries. Ukraine’s strikes on Russia’s energy infrastructure are already having a meaningful impact on the world's second-largest exporter of crude oil, particularly its refining industry.

Reduced domestic oil processing capacity has prompted Russia to increase its August crude oil exports from western ports by 200,000 bpd, or 11%, media reported, because reduced domestic refining capacity means that increased volumes are available for export.

The strikes also triggered gasoline shortages in parts of Russia, even after Moscow imposed a gasoline export ban for oil producers on July 28 to prevent supplies from falling too low during peak summer demand.

The problem won’t be fixed any time soon. Repair work on damaged refineries could take weeks or longer, tightening fuel supplies domestically and internationally at a time when many of the world's refineries are entering seasonal maintenance ahead of winter.

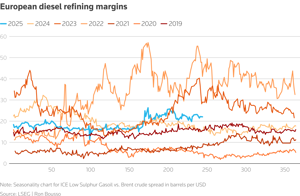

Expanding margins. Refineries worldwide have enjoyed strong profit margins this year, buoyed by robust diesel demand despite concerns about a potential slowdown in global economic activity stemming from the U.S. trade war. Supply has also been relatively stable, with closures of several European refineries offsetting new capacity additions in the Middle East, Mexico and Africa.

(click image to enlarge)

Benchmark European diesel refining margins are $23.50 a barrel, roughly 40% higher than this time last year, LSEG data shows.

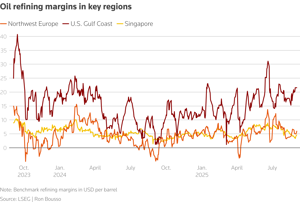

But declining Russian diesel exports could apply downward pressure on global supply, further boosting refining margins, particularly for U.S. Gulf Coast refiners that export the majority of their product.

Russian seaborne diesel exports declined in August to 744,000 bpd from 828,000 bpd in July, according to data from analytics company Kpler. That is only slightly lower than last year's 750,000 bpd in August exports, but the Ukrainian strikes mean volumes are likely to remain depressed.

Reflecting expectations of tighter supply, the six-month forward spread for the ICE diesel contract has more than doubled since August 18 to about $50 a ton, LSEG data shows.

More turmoil ahead? Before Moscow’s 2022 invasion of Ukraine, Europe was the largest buyer of Russian diesel, meeting 40% of its import needs and a quarter of its total consumption.

The EU and Britain halted Russian fuel imports in 2023, turning instead to Middle Eastern and Indian refiners, some of which used Russian feedstock.

However, in July, the EU adopted its 18th package of sanctions against Russia, which included a ban on imports of refined products made from Russian crude, which is set to kick in next year.

The ban largely targets India, which has become the second-largest buyer of Russian crude behind China. India imported 1.9 MMbpd in 2024, nearly 20% of total Russian crude exports, IEA data shows.

Trump said on Sunday that he was ready to move towards a second phase of sanctions against Moscow, suggesting an increasingly aggressive posture. Sanctions could target Brazil’s purchases of Russian diesel, which could further disrupt global supplies.

While the latest damage to Russian energy infrastructure is likely to complicate the supply outlook for refined products, it could provide a boost for refiners outside Russia, particularly those in the United States.

(click image to enlarge)

Comments