China state refiners ramp up output on rising demand, stock rebuild

- Operating rates at state refineries surpass 80% in late-June

- Refining output to rise by about 100,000 bpd in July from June

- Diesel, gasoline stocks at multi-year lows, partly due to teapot output cuts

- Q3 demand up seasonally but pressure remains

Chinese state-owned refiners are ramping up output after completing maintenance to meet higher third-quarter fuel demand and to rebuild diesel and gasoline stocks which are at multi-year lows, traders and analysts said.

The increase in crude processing rates, expected to last through the third quarter, will drive up imports by the world's largest oil importer, although slowing gasoline and diesel consumption is expected to keep a lid on overall demand.

Operating rates at state refineries surpassed 80% in the last week of June, up from about 73% a month earlier, the highest for the period in five years, data from consultancy Oilchem showed, as several Sinopec refineries returned to operation from maintenance in the second quarter.

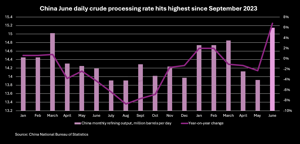

China's overall refining throughput was 15.15 MMbpd in June, the highest since September 2023, according to calculations based on official data released on Tuesday.

The sharp ramp-up in state refinery operations was driven by low product stocks after two months of heavy maintenance in April and May that supported product profit margins, said Ye Lin, a vice president at Rystad Energy.

"Demand for jet fuel and petrochemical feedstocks is growing healthily in China, driving more supply from the state-owned refineries," she added.

Refined products output from state refiners Sinopec, PetroChina, CNOOC and Sinochem will exceed 10 MMbpd in July, 100,000 bpd–110,000 bpd higher than June, according to consultancies FGE and JLC.

FGE expects their output to hit 10.4 MMbpd in July and August.

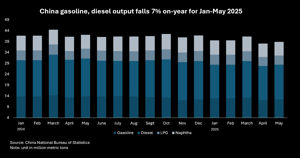

(click image to enlarge)

JPMorgan analysts forecast China's refinery runs to increase year-on-year for the third and fourth quarters, following consecutive annual declines in the previous five quarters.

Rising state refinery output pushed up diesel and gasoline stocks in the first two weeks of July, but at 14 MM tonnes (t) and 11 MMt, respectively, inventories are at six-year lows, Oilchem data showed.

(click image to enlarge)

Official data showed China's January–May diesel and gasoline production fell 7% annually. That is partly because independent refineries, known as teapots, have been operating at just 40%–50% of their capacity this year due to poor margins, and as U.S. sanctions made it harder for some to buy cheap Iranian oil, industry sources said.

Demand. China's oil demand will rise seasonally into September but will be restrained by the country's prolonged property sector downturn, trade tariffs and rising sales of electric cars and trucks, the sources and analysts said.

Barclays estimates that China's oil demand grew about 330,000 bpd year-on-year in the first half this year, while full-year growth will ease to 150,000 bpd.

For July, China's gasoline consumption has firmed due to the summer travel season, but diesel demand remains weak as extreme weather, such as heatwaves and floods, has delayed construction projects in some regions, sources and analysts said.

Rystad's Ye expects teapots to increase runs in August to meet higher fuel demand in September.

Diesel and gasoline make up more than 40% of China's oil demand.

Comments