China ramps up exports of refined fuels as margins rise

China's exports of key refined fuels are on track to jump to the highest in 16 months as refiners take advantage of rising profit margins.

Shipments in July of middle and light distillates, which include diesel and gasoline, are forecast to reach 26.63 MM barrels, or 859,000 barrels per day, data compiled by commodity analysts Kpler shows. This figure is up from 796,000 bpd in June and the highest since the 1.06 MMbpd in March 2024, the data shows.

China's refiners have substantial spare capacity to ramp up output while their unused export quotas will allow them to take advantage of rising profit margins for refined fuels, especially gasoil, the building block for diesel and jet kerosene.

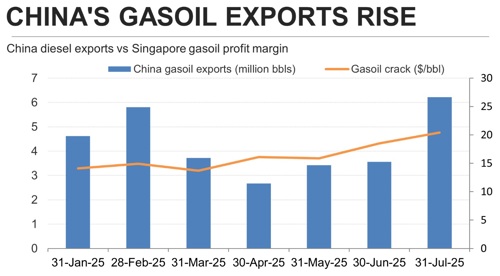

The crack spread, or profit margin, for producing a barrel of 10 ppm gasoil in Singapore ended at $20.43 a barrel on Monday, up from the prior close of $21.00.

The margin is down from the 16-month high of $22.85 a barrel from July 18, but is 56% higher than the low so far this year of $13.05 on March 25.

China's gasoil exports are forecast at 6.22 MM barrels in July by Kpler, the highest since June 2024 and up from just 3.56 MM last month.

Data from LSEG Oil Research is slightly more bullish, with gasoil exports pegged at 6.55 MM barrels for July, more than double the 3.13 MM recorded for June.

China's exports of other middle distillates, such as jet kerosene, also rose in July, with Kpler estimating shipments of 9.59 million barrels, up from 8.65 million in June and the most since January.

More to come? There is also scope for China to increase shipments in coming months, as refiners still have unused export quotas. Total export quotas granted by Beijing to refiners amount to 45 MM metric tons and official customs data shows total refined product exports of 27.19 MM in the first half of 2025, a decline of 9.7% from the corresponding period in 2024.

China's refiners have been increasing output, with throughput rising 8.5% in June to 15.15 MMbpd, official data showed on July 15.

That was the highest daily processing rate since September 2023 and it is likely that refiners are seeking to take advantage of rising prices for refined fuels while processing crude secured when oil prices were trending lower at the start of the second quarter.

China is also shipping more gasoline, with LSEG estimating July exports of 6.7 MM barrels, up from 5.7 MM in June and the most since March.

The profit margin for gasoline in Singapore has not been as strong as that for diesel, ending at $7.43 a barrel on Monday, up from $7.41 at the previous close. The margin is down from the year's high so far, of $11.83 a barrel on May 9, but is still double the low of $3.68 hit on January 21.

The current pricing for refined fuels is enough to encourage further Chinese exports in coming months. The case may be further supported if new European Union sanctions targeting Russian fuel exports do result in a shifting of flows around the globe.

The EU is banning imports of refined products made from Russian crude, which will mainly impact refiners in India, who have been buying discounted Russian oil and exporting fuels to both Europe and Asia.

While Chinese refiners also buy Russian crude it will be easier for them to show which individual plants do not use Russian oil, and therefore can still export to Europe.

Currently, hardly any Chinese refined products end up in Europe, but it becomes a possibility if Indian refiners are forced to look for new markets outside Europe, and European buyers are forced to look for new suppliers.

Comments