Private refiners tap India's drivers as export markets tighten

- India's gasoline, diesel demand keeps growing, while China has peaked

- Reliance, Nayara diesel market share doubled over past two years

- Cheap Russian crude helps Reliance, Nayara in pump price war

- Competition spawns gyms, dorms, haircuts at new fuel stations

India's two major private-sector refiners, which have long prioritized exports, are turning to local sales, grabbing share in the country's fast-growing $150-B fuel retail market as weaker global demand squeezes profit margins offshore.

Reliance Industries and Nayara Energy are stepping up sales at home as fuel demand growth slows in developed markets and China, the world's second biggest oil consumer, with the transition to electric vehicles.

The lower demand offshore combined with supply competition from new refiners, such as Dangote in Nigeria, and rising exports from China's underutilized processors have compressed global refining margins and have made the Indian market, where suppliers save on freight and taxes, more attractive.

As a result, "private refiners are increasingly looking to supply to the domestic market, which is still growing at a healthy pace," said Prashant Vasisht, senior vice president at credit rating firm ICRA.

The International Energy Agency expects India will become the largest source of global oil demand growth out to 2030, in contrast with China, where fuel demand may have already peaked.

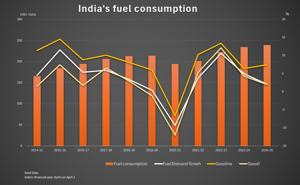

FGE analyst Dylan Sim said Indian gasoline consumption and diesel demand are on track to grow around 4% and 2% per year, respectively, over the next decade or so.

(click image to enlarge)

"Couple that with the market volatility and uncertainties seen in recent years, it makes sense for these private companies to try and diversify their businesses," Sim said.

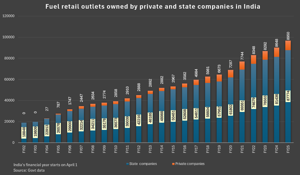

Private plants hold crude advantage. Offering discounts and growing their networks of big, modern stations featuring expansive retail offerings, private sector operators expanded their share of diesel sales to 11.5% and gasoline sales to 9.2% in the fiscal year that ended in March 2025, up from 5.2% and 6.7%, respectively, two years earlier, government data showed.

Reliance, controlled by billionaire Mukesh Ambani, and Nayara have a key advantage that allows them to undercut the dominant state-owned refiners at the pump. They can run cheaper crudes through their plants than their bigger rivals, which have simpler, aging refineries.

The two are the country's biggest buyers of discounted Russian crude, available since 2022.

While the private refiners do not publish their refining margins, analysts at Jefferies expect Reliance's margin to hold around $2 a barrel stronger than the benchmark Singapore refining margin due to its blending of cheaper Russian and Canadian crudes.

(click image to enlarge)

Reliance sells fuels through Jio-BP, its retailing tie-up with UK major bp which has 1,916 outlets in India.

Its domestic sales volumes of diesel rose by 35% and gasoline by 24% in the quarter ended in March from a year ago, Reliance told analysts in May, without specifying volumes.

Jio-BP plans to invest about 10 B rupees ($117 MM) annually to expand its local footprint in coming years as it sees a "long pathway" and growth in diesel demand in India through at least 2040, Vinod Tahiliani, chief financial officer at Reliance BP Mobility, said.

Jio-BP offers discounts of 1 rupee ($0.01) per liter of diesel and petrol off the price charged by state-owned retailers at its service stations.

Nayara, whose biggest shareholder is Russia's Rosneft, in April reintroduced discounts of 2-3 rupees per liter on gasoline and 1 rupee per liter on diesel. Selling through more than 6,500 fuel stations, it aims to add 400 this year, according to its website. Nayara did not reply to a request for comment.

State players Indian Oil Corp., Hindustan Petroleum Corp. and Bharat Petroleum Corp., which operate more than 90% of India's roughly 97,000 filling stations, have not cut pump prices as they seek to recoup losses on sales of cooking gas at government-fixed below-market rates, company sources say.

Service stations get creative. India, meanwhile, is expanding its highway network and auctioning large roadside plots for building fuel stations featuring a host of amenities for motorists.

Sukhmal Jain, who recently retired as head of marketing at BPCL, said state refiners are rapidly building their networks, including bidding for highway-side plots, and looking to offer services such as eateries, recreational areas and gym facilities in order to compete and boost sales.

The state retailers are also opening stores under a common brand name Apna Ghar, which means "Own House", with amenities such as dormitories, barbers, self-cooking facilities, laundry and doctors on call for truckers who are on the road for more than 20–25 days a month, Jain said.

India's oil ministry said recently that Apna Ghar operates at 350 locations with 4,431 beds.

S.P. Singh, who manages a fleet of about 800 trucks and 150 trailers for New Delhi-based Chaudhary Transport, said his drivers are drawn to the amenities and cheaper fuel at private operators.

"They have convenience stores and cafes. Their staff is more responsive to customers and their toilets are clean," he said.

($1 = 85.7900 Indian rupees)

Comments