California (U.S.) fuel imports hit 4-yr high amid refinery outages

- Outages at Chevron, PBF, Valero refineries caused crunch

- State's reliance on fuel imports may grow amid planned refinery closures

- Imports mainly from Asia, the Bahamas increase

- Opening of unusual trade routes could dampen extreme price spikes

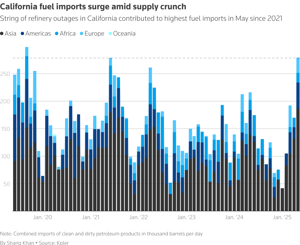

California's fuel imports rose to the highest in 4 yr in May as refiners turned to historical trading partners in Asia and tapped some unusual routes to make up for shortages in the No. 2 U.S. oil consumer state, according to shipping data and traders.

The rise in shipments to California offers an early look at the future of the biggest gasoline and jet fuel markets in the U.S., which are expected to become more reliant on imports after Phillips and Valero close two major refineries in the state by next year, amid growing regulatory and cost pressures, and declining demand for gasoline.

"California's refining capacity is shrinking faster than its fuel demand is declining, forcing the state into a long-term import-dependent position," Kpler analyst Sumit Ritolia said.

(click image to enlarge)

California's total petroleum product imports rose to 279,000 bpd in May, the highest since June 2021, when a similar volume was imported, according to data from vessel tracker Kpler.

About 187,000 bpd, or nearly 70% of the imports came from South Korea and other Asian exporters, who have historically been the top trading partners for California and other West Coast states, which are geographically isolated from major U.S. refining centers along the Gulf Coast.

Recent outages in California at refineries owned by Chevron, PBF Energy and Valero caused a supply crunch in markets along the U.S. West Coast that necessitated more imports, traders and analysts said.

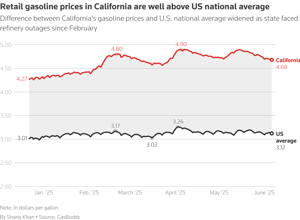

"We have seen tighter supplies due to several refinery outages," StoneX oil analyst Alex Hodes said. That boosted prices in the U.S. Pacific Northwest substantially and led to increased imports, he said.

There were several days where San Francisco gasoline was more than $40 a barrel above Gulf Coast pricing, nearly double the year-to-date average of $21, WoodMac analyst Austin Lin said.

Unusual routes. California's imports from the Bahamas, a trade route rarely used by West Coast refiners, hit a record high of 38,000 bpd in May, Kpler data showed. The previous record was 29,000 bpd in March.

Flows on the route from the Caribbean were sporadic before this year's refining outages, averaging just 6,000 bpd throughout last year, the data showed.

The Bahamas does not refine oil but exports fuel and blending components shipped there from the U.S. Gulf Coast refining hub as part of a workaround to a century-old U.S. shipping law to supply fuel to the East Coast when pipeline shipments are insufficient.

The Jones Act bars movement of goods between U.S. ports unless carried by ships built domestically and staffed by local crew. However, there were only 55 such petroleum tankers as of the start of 2024, according to a government report, making them expensive and hard to procure.

Sailing a tanker from Texas to California via the Bahamas is typically too expensive, but the recent refinery outages opened up the arbitrage to the West Coast from everywhere, a second U.S. gasoline trading source said.

Ample availability in the Atlantic Basin of alkylate - a blending component highly sought for California's unique blend of CARBOB gasoline - could have also contributed to the uptick in imports from the Bahamas, Sparta Commodities analyst Philip Jones-Lux said.

Meanwhile, California imported 39,000 bpd of gasoline and alkylate from India last month, the highest since January 2024, Kpler data showed.

More waterborne imports will raise fuel costs in the most populous U.S. state, GasBuddy analyst Patrick De Haan said.

However, the opening up of these unusual trade routes in May shows the state still has options to shield consumers from extraordinary price spikes, he said.

Retail gasoline prices averaged $4.68 a gallon in California on Friday, while the national average was $3.12, according to GasBuddy data.

Comments