Asia-Pacific on course to become world’s largest CO2 shipping market

- Japan and Korea expected to lead carbon capture, utilization and storage (CCUS) demand

- Storage need could require offshore industry similar in scale to Australia’s gas infrastructure

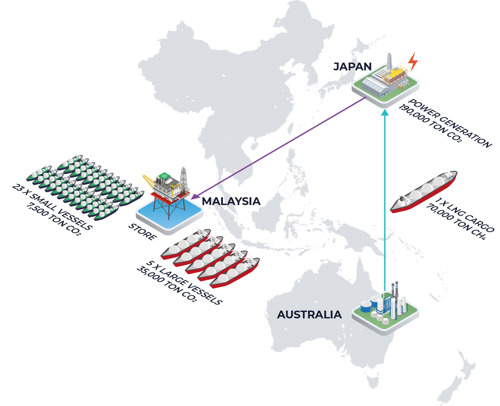

Vast distances between emitters and storage sites in Asia-Pacific (APAC) means the region is in line to become the world’s largest carbon dioxide (CO2) shipping market, according to a new CCUS report from global energy consultancy Xodus.

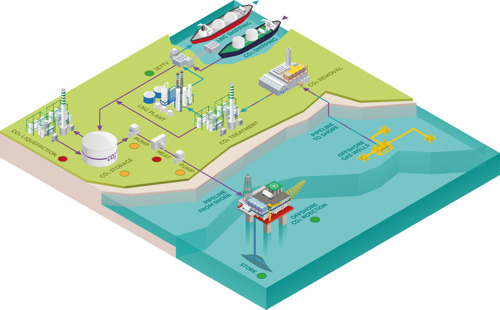

Produced in partnership with Subsea7, Forecasting the APAC CCUS Infrastructure finds that by 2055, Asia-Pacific could require > 90 storage sites, around 8,000 km of pipelines and almost 80 specialist vessels to deliver its CO2 sequestration needs.

In Japan and Korea—both of which currently lack significant oil and gas production but are expected to lead CCUS demand in the region—the requirement for storage could necessitate an offshore industry similar in scale to the gas infrastructure currently operational in northwest Australia.

The report, the third in a series of publications on the global outlook for CCUS, also finds that CCUS projects linked to LNG assets could reduce costs by 10%–15%, the equivalent of shortening shipping distances by over 3,000 km, helping to bridge the initial gap between emitters and stores.

Simon Allison, Vice President APAC, Xodus, said: “As the urgency to tackle climate change intensifies, CCUS has staked a claim as one of the most effective and immediate solutions to reduce greenhouse gas emissions, particularly from hard-to-abate sectors such as cement, steel and fossil fuel power generation. These sectors are critical to economies in the region.

“CCUS is already proven, mature and can be deployed without requiring significant changes in consumer behavior. Our latest study provides a comprehensive view of the infrastructure required to enable cost-efficient CO₂ transport and storage across the APAC region.

“While APAC currently trails areas like the North Sea in terms of deploying commercial-scale CCUS to serve industrial emitters, its large emissions footprint and operational experience in CO2 re-injection positions it to become a global hub for CCUS development in the decades ahead.”

Unlike Europe, where most CCUS projects rely on nearby emitters mainly served through pipelines, Asia-Pacific will initially depend on international emitters and long-distance shipping, with local emitters providing a small portion of the demand.

While early offshore transport and storage costs are high due to the vast distances involved, Xodus expects them to fall as local stores near to demand centers are developed and new market entrants cause tariffs to drop.

Moreover, Asia-Pacific’s high density of industrial and power emissions will also help to keep capture and onshore collection costs low, making CCUS highly competitive in the longer term.

Olivier Mette, Global Advisory Director, Xodus, said: “Our research outlines the projected development of offshore CCUS infrastructure across 10 APAC countries between 2035 and 2055, highlighting the region’s unique challenges and opportunities.

“China and India are expected to focus on domestic storage solutions, but many APAC nations face vast distances - sometimes over 5,000 km - between CO₂ emitters and suitable offshore storage sites. This mismatch is a defining feature of the region’s CCUS landscape.

“Our analysis, backed by regionally adjusted cost assumptions and a robust, bottom-up methodology reviewed by leading industry bodies, demonstrates that while early projects will face high transport costs, these are expected to fall significantly as infrastructure scales and more emitters enter the market.

“International collaboration, shipping infrastructure and regulatory alignment will be critical to unlocking APAC’s potential to become a world leader in cost-effective, large-scale CCUS deployment.”

Based on the current outlook, Xodus expects that almost 80 vessels for interregional shipping will be needed in 2055, the equivalent of 20% of Asia’s current LNG fleet.

When using tonnage as a comparison, the study finds that building six CO2 carriers per year over 15 yr is eminently achievable.

Comments